Memory chip market enters "supercycle": prices double, capacity grabbing, South Korean companies rake in hundreds of billions in profits.

In 2025, the global memory chip market ushered in a historic "supercycle," with DRAM and NAND flash memory prices soaring and SSD controller chip shipments experiencing explosive growth. The industry's supply and demand structure, profit structure, and competitive landscape are undergoing profound reshaping. South Korean chip giants, leveraging their technological and production capacity advantages, were the first to reap the benefits. The impact of this wave of price increases has permeated the entire industry chain, from data centers to consumer electronics.

Looking at price trends, the price increases in the memory chip market in 2025 far exceeded industry expectations. According to a report by Fast Technology in October, DRAM and NAND flash memory prices have continued to climb this year, with some categories seeing increases of up to 100%. DDR4 and DDR5 memory spot prices are particularly prominent—CCTV monitoring data shows that the price of 16GB DDR4 memory modules has increased by over 200% compared to 2024, and the unit price of enterprise-grade SSDs has also increased by over 60% year-on-year, maintaining a weekly increase rate of 5%-8%. As a core component of storage modules, SSD controller chips saw a 300% surge in monthly shipments, with delivery cycles for some models extending from the usual 4 weeks to over 12 weeks, indicating a tight supply situation.

Research data further confirms this market frenzy. TechInsights statistics show that DRAM spot prices rose rapidly from a 4% year-on-year increase in April 2025 to nearly 200% year-on-year in September, while inventory cycles plummeted from 31 weeks at the beginning of 2023 to 8 weeks, the lowest level in nearly a decade. TrendForce has repeatedly raised its price forecasts, significantly revising its Q4 estimate for general memory price increases from 8%-13% to 18%-23%, and pointing out that if the supply-demand gap continues to widen, the increase could further exceed 25%.

This dramatic reversal in supply and demand is the core logic behind this round of price increases, driven by both "supply contraction" and "demand explosion." On the supply side, the collective production cuts initiated by global memory manufacturers in 2024 began to show their concentrated effects in 2025. Following the price slump of 2023-2024, leading companies such as Samsung, SK Hynix, and Micron reduced their production capacity of mid-to-low-end DRAM and NAND to improve profitability, shifting the industry from "overstock" to "supply shortage." More importantly, a profound adjustment in production capacity structure occurred—to pursue higher profits, mainstream manufacturers shifted a large amount of capacity to AI-related high-end memory products, especially high-bandwidth memory (HBM).

As a core component of AI Server Gpus, HBM demand is experiencing exponential growth with the spread of generative AI. Global tech giants are projected to invest $400 billion in AI infrastructure by 2025, with AI server procurement increasing by 120% year-on-year. Each high-end AI server requires 8-16 HBM chips, directly driving the HBM market size to exceed $20 billion. To seize this high-profit segment, Samsung has shifted 15% of its DRAM production capacity to HBM, while SK Hynix has opened its M15X cleanroom ahead of schedule and introduced next-generation production equipment, increasing its HBM capacity to over 100,000 wafers per month. Simultaneously, it plans to completely cease DDR4 production by early 2026, focusing entirely on DDR5 and HBM.

The surge in demand across multiple scenarios has further amplified the supply-demand gap. In addition to the high-end demand from AI servers, the replacement cycle of traditional data centers and the recovery of the consumer electronics market are resonating: servers purchased during the previous boom in 2017-2018 are entering their replacement window, leading to a concentrated release of bulk purchasing demand from data center operators for high-capacity DDR5 memory and enterprise-grade SSDs. SK Hynix's financial report shows that in the third quarter of 2025, shipments of high-capacity DDR5 memory (above 128GB) will double quarter-on-quarter, and the proportion of enterprise-grade SSDs (eSSDs) will increase to 35%. In the consumer electronics sector, global smartphone sales rebounded by 8% year-on-year, and PC shipments stopped declining and began to recover, driving a simultaneous increase in demand for consumer-grade storage, forming a pattern of comprehensive expansion in demand across both the high-end and mid-to-low-end markets.

The chain reaction in the supply chain further exacerbated market tensions. Semiconductor distributors generally reported that since the second half of 2025, customers have generally adopted a strategy of "double" or even "triple" orders to avoid the risk of price increases. Some companies have extended their memory chip inventory from the usual 3 months to 6-9 months, and this "hoarding behavior" has further amplified the actual supply-demand gap. Production data from ADATA, the world's second-largest memory module manufacturer, shows that in the third quarter of 2025, the capacity utilization rate of memory modules remained at an overloaded state of 105%, still unable to meet customer order demand. The "shortage wave" is expected to escalate further in the fourth quarter.

In this industry boom, South Korean chip giants have become the biggest beneficiaries, with both market share and profitability reaching new highs. Samsung Electronics, leveraging its technological advantages in HBM and DDR5, regained its dominant position in the global memory chip market in the third quarter of 2025. Its global DRAM market share rebounded to 43%, and its NAND market share reached 32%. The operating profit margin of its standard DRAM business exceeded 40%, driving Samsung Electronics' overall operating profit up by 95% year-on-year, and its stock price rose by over 80% year-to-date.

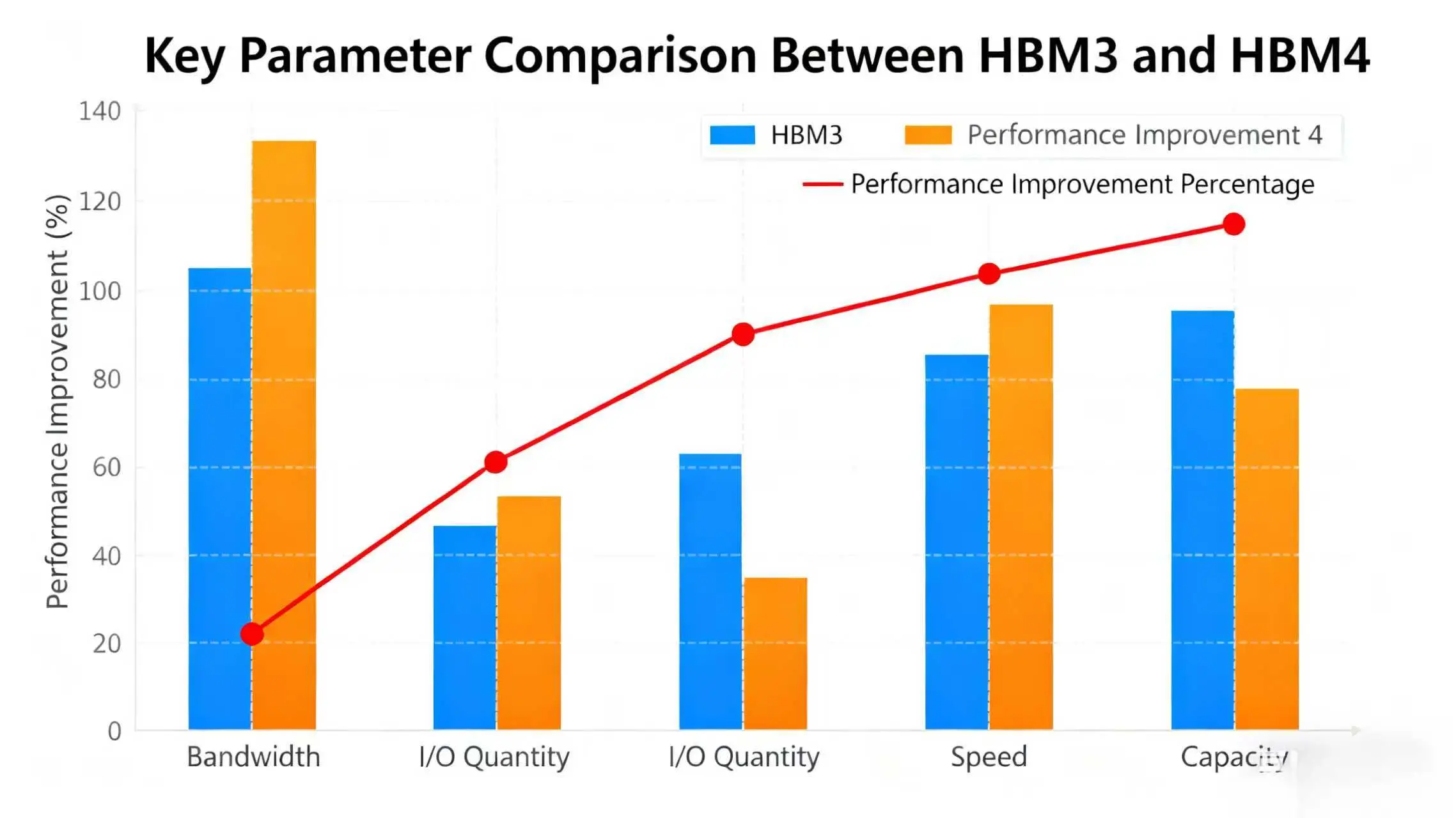

SK Hynix's performance was even more impressive. In the third quarter of 2025, the company's revenue reached 24.4489 trillion won (approximately US$18 billion), operating profit reached 11.3834 trillion won (approximately US$8.4 billion), and net profit margin reached a record high of 52%, setting a new quarterly profit record since the company's inception. Benefiting from the explosive growth of its HBM business, SK Hynix's market capitalization surged by over $100 billion in September alone, with cash and cash equivalents reaching 27.9 trillion won (approximately $20.6 billion) and a net cash position of 3.8 trillion won (approximately $2.8 billion). Currently, SK Hynix has completed the development of its HBM4 product and started mass production. HBM shipments are expected to exceed 150,000 units in the fourth quarter of 2025, and the company has secured customer demand for its entire product line in 2026. It plans to further increase capital expenditure in 2026 and accelerate the conversion to advanced processes to expand its capacity advantage.

The industry is generally optimistic about the sustainability of the "supercycle." TrendForce predicts that, supported by long-term demand for AI servers, DDR5 contract prices will maintain an upward trend throughout 2026, with the most significant increase in the first half of the year, and an estimated annual increase of 20%-25%. More noteworthy is the change in profit structure – as DDR5 prices continue to rise, the price difference between it and HBM3e is rapidly narrowing. It is projected that starting in the first quarter of 2026, the unit profit of DDR5 will surpass that of HBM3e for the first time. This change may drive manufacturers to further increase DDR5 production capacity, forming a new pattern of "balanced growth between high-end and general-purpose products."

However, behind this prosperity lie risks and challenges. The downstream supply chain is facing the "transmission effect" of cost pressures. For consumer electronics companies, the cost share of memory chips has risen from 12% in 2024 to 25% in 2025. Some mid-to-low-end smartphone and PC manufacturers have already started raising prices. In October 2025, British PC manufacturer Raspberry Pi announced a 5%-10% price increase across its entire product line, directly due to a roughly 120% increase in memory chip costs compared to a year ago. Server manufacturers are also under pressure. Dell, the world's leading server manufacturer, reported a 45% year-on-year increase in storage component procurement costs in the third quarter of 2025, leading to a 3 percentage point decrease in the gross margin of its server business. Cost pressures are beginning to be transmitted to the end-user market.

Market vigilance regarding cyclical fluctuations has never eased. Dan Hutcheson, Vice Chairman of TechInsights, pointed out that the current so-called "supercycle" is essentially a continuation of the "classic shortage cycle," typically lasting 1-2 years. With the gradual release of new capacity from manufacturers like Micron and Yangtze Memory Technologies in the second half of 2026, the storage market may enter a new adjustment period in 2027. Furthermore, investor concerns about an artificial intelligence bubble are also rising—if tech giants slow down their investment in AI infrastructure in 2026, it could trigger a temporary pullback in storage demand, bringing uncertainty to industry growth.

From a global supply chain perspective, this "supercycle" is further widening the gap between leading companies and second-tier manufacturers. While Chinese memory companies have made breakthroughs in the low-to-mid-range DRAM and NAND fields, increasing their global market share in this segment to 18% by 2025, they still lag behind South Korean companies by 2-3 generations in high-end areas such as DDR5 and HBM. This makes it difficult to change the current situation where Samsung and SK Hynix dominate 70% of the global DRAM market in the short term. However, signs of technological breakthroughs are beginning to emerge—Fudan University's "CY-01" 2D-silicon hybrid architecture flash memory, launched in October 2025, boasts 50% higher performance and 30% lower costs than traditional 3D NAND, providing a new path for global memory technology development and potentially becoming a key variable in changing the competitive landscape of the industry.

Faced with this "supercycle," all links in the industry chain are actively adjusting their strategies to meet the challenges. Enterprise users are generally optimizing their storage architecture, reducing their reliance on high-end storage chips through virtualization and tiered storage technologies, while signing 1-2 year long-term supply agreements with suppliers to lock in costs. Storage module manufacturers are accelerating their in-depth cooperation with chip manufacturers, ensuring supply chain stability through a "joint R&D + capacity reservation" model. Ordinary consumers also need to rationally assess their needs and avoid blindly hoarding – after all, the cyclical nature of storage chips has never changed, and short-term price fluctuations will not alter the long-term trend of technological upgrades.

It is worth noting that the pace of innovation in storage technology has not slowed due to the price surge. In October 2025, the JEDEC organization confirmed that the next-generation mobile/embedded storage standard UFS 5.0 will be released in the first quarter of 2026, with sequential read speeds exceeding 10GB/s, comparable to early PCIe 5.0 SSDs. This technological upgrade will further empower the storage capabilities of AI devices and edge computing devices, injecting new momentum into industry growth.

Overall, the "supercycle" in memory chips that began in 2025 is both a short-term result of supply and demand imbalances and a microcosm of long-term demand changes driven by AI and digital transformation. Although short-term cyclical fluctuations are inevitable, against the backdrop of explosive growth in data volume, the long-term value of memory chips as the "cornerstone of the digital world" has become increasingly prominent, and the industry is accelerating its evolution towards "high-end technology, application scenarios, and concentrated competition."