Skyrocketing memory prices trigger a chain reaction in the AI server industry: 6% price surges, delivery delays, and a major supply chain test for computing infrastructure.

Since the third quarter of 2025, the continued surge in DDR4 and DDR5 memory prices has triggered a chain reaction across the industry chain, with AI servers bearing the brunt of the impact. Whole-unit prices have risen by nearly 6%, and delivery cycles have generally lengthened by one to two months. This industry turmoil, triggered by an imbalance in memory chip supply and demand, is putting a severe strain on the supply chain for China's rapidly expanding computing infrastructure.

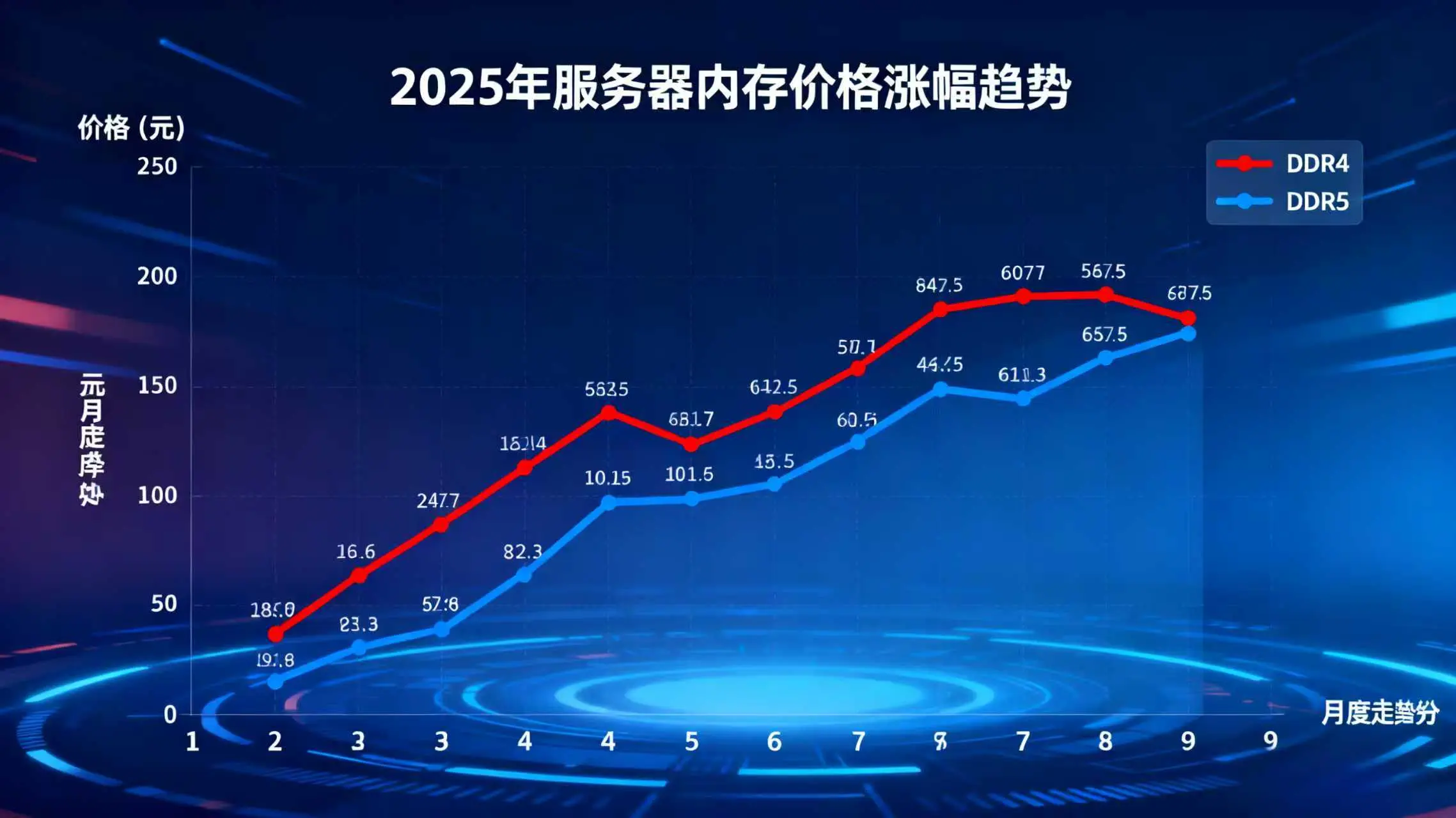

The surge in memory prices is the trigger: DDR4 prices have doubled, and DDR5 prices are skyrocketing, primarily due to structural shortages.

Market data indicates that memory prices will experience a steep upward trend in 2025. For example, the price of a 16GB DDR4 memory stick, a mainstream specification, rose from 180 yuan at the beginning of the year to 520 yuan by the end of September, an increase of over 180%. The price of 32GB DDR5 server-specific memory soared from 800 yuan to 2,200 yuan, nearly tripling in just nine months. Some scarce models are even out of stock. TechInsights' latest industry report shows that global DRAM spot prices in September 2025 nearly tripled compared to the same period in 2024 and surged 190% compared to April 2025, marking the largest single-quarter increase since 2021, and this upward trend is expected to continue.

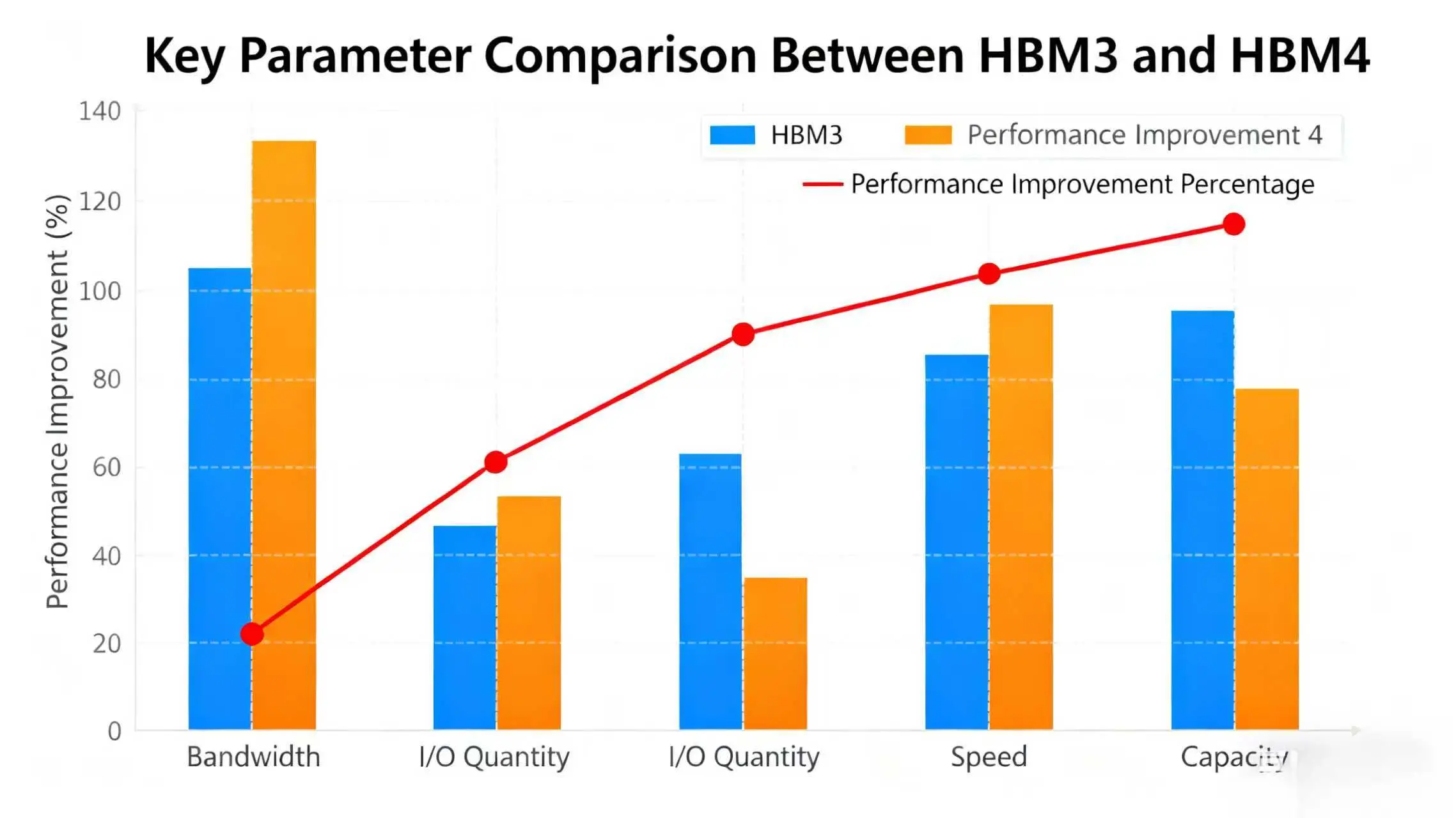

The core reason for the surge in memory prices lies in the structural adjustments in the global memory chip industry. Samsung and SK Hynix, leading companies holding 70% of the global DRAM market share, have been gradually reducing DDR4 production capacity since early 2025 and plan to completely cease DDR4 memory chip production by the end of 2025, focusing their production lines on more profitable DDR5 and HBM (High Bandwidth Memory) products. Driven by the AI boom, HBM chip profit margins can reach over three times that of standard DDR5 chips. This shift in production capacity by leading manufacturers has directly led to a sharp drop in standard memory supply. While local companies like Changxin Memory are accelerating production expansion, the long cycle for capacity release makes it difficult to fill the market gap in the short term, creating a "supply and demand mismatch."

To make matters worse, panic buying has further exacerbated the supply-demand imbalance. Fusion Worldwide's industry analysis indicates that global memory demand will surge 200%-300% year-on-year from July to September 2025. Downstream companies are generally adopting a strategy of doubling or even tripling orders to lock in supply in advance to mitigate the risk of price fluctuations. This irrational purchasing behavior, combined with capacity reductions by leading manufacturers, has led to a continued exacerbation of the memory shortage. ADATA, the world's second-largest storage module manufacturer, stated at a recent industry conference that the current widespread shortages and price increases in all four major storage categories, including DRAM and NAND flash memory, are unprecedented in its more than 30 years of industry development.

AI servers are facing a double blow: a 6% price jump, delivery delays, and impacted computing deployment progress.

Memory, as a core component of AI servers, has a significant impact on overall system cost due to price fluctuations. Compared to general-purpose servers, AI servers require higher memory capacity and performance. An eight-GPU training AI server requires 32 DDR5 memory modules, increasing the memory cost from the typical 15% to 28% of the total server cost. Industry estimates show that, for a mainstream AI server for inference, the increased memory cost alone results in a price increase of 4,500 yuan per device, or nearly 6% for the entire server. Training AI servers, due to their greater memory requirements, see price increases of 8%-10%.

Since August 2025, major domestic server manufacturers such as Huawei, Inspur Information, H3C, and Super Fusion have issued two rounds of price adjustments, passing on the increased memory costs to the downstream market. More critically, the unstable supply of DDR5 memory has directly hindered server production and significantly extended delivery cycles. According to publicly disclosed information from companies, the delivery cycle for conventional AI servers has extended from 45 days to over 75 days, with the delivery cycle for some customized models even exceeding three months, a one-to-two month increase compared to the previous period.

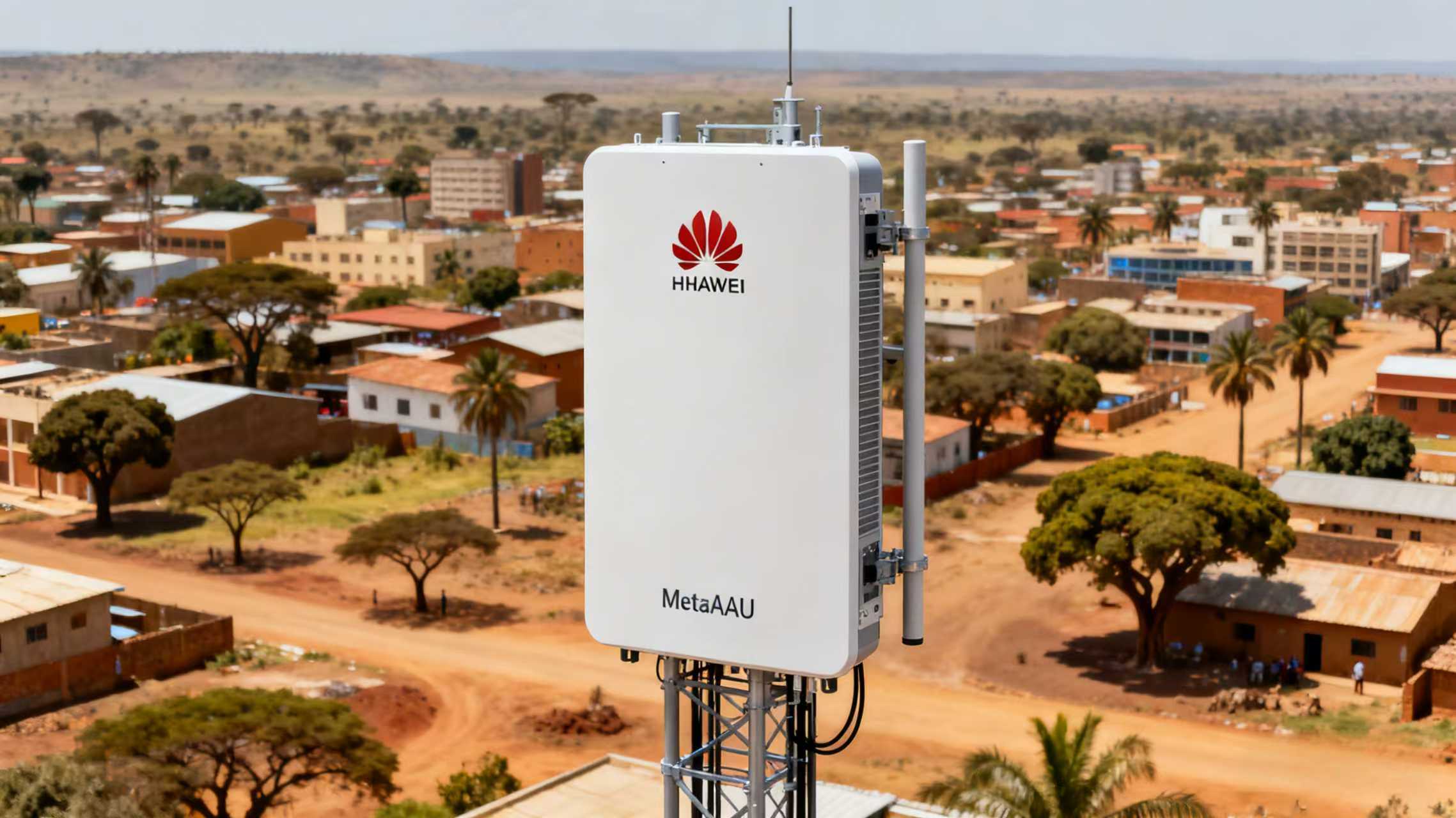

The AI server supply shortage has had a direct impact on downstream computing power deployment. According to industry research, Alibaba Cloud was forced to scale back its planned deployment of 1,000 intelligent computing servers by the third quarter of 2025 due to hardware shortages. Tencent Cloud has temporarily migrated some AI inference tasks to existing equipment to alleviate computing pressure. Among the three major operators, China Mobile faces delivery delays for 20% of its 7,058 inference-capable AI servers, which were centrally purchased for 2025-2026. This could impact the construction of 5G base station edge computing nodes.

From a technical perspective, AI servers utilize a heterogeneous CPU+GPU architecture. Memory is the core hub for data flow between the CPU and GPU. Memory shortages have directly led to a significant decline in server capacity utilization. Industry data shows that the average capacity utilization rate of domestic AI server manufacturers fell from 90% to 65% in the third quarter of 2025. For some companies relying on imported DDR5 memory, capacity utilization is even below 50%. Storage manufacturers such as ADATA have predicted in their industry forecasts that the fourth quarter of 2025 will be the peak period for severe memory chip shortages, with supply constraints expected to persist in the first half of 2026. The pressure facing the AI server industry is unlikely to ease in the short term.

A chain reaction is emerging: impacting the entire supply chain, from upstream chips to downstream applications.

The ripples caused by the memory shortage are spreading upstream and downstream along the AI server industry chain, impacting the entire supply chain. In the upstream memory chip sector, the stock prices of leading manufacturers have already reacted first—Samsung's stock price rose by over 80% in 2025, while SK Hynix and Micron's stock prices soared by 170% and 140%, respectively. The capital market has reached a consensus on the expectation of a "super cycle" in the memory chip industry, with some investment institutions even listing memory chips as the most investment-worthy semiconductor segment in 2025. In the midstream server foundry sector, while Foxconn Industrial Internet, the world's largest AI server manufacturer, achieved year-on-year AI server revenue growth exceeding 60% in the first half of 2025, it has recently experienced delivery delays for some overseas orders due to unstable DDR5 memory supply. To ensure supply chain stability, Foxconn Industrial Internet has signed long-term supply agreements with Samsung and Micron, locking in 30% of its DDR5 memory production capacity through 2026. The company has also extended its memory procurement cycle from three months to six months, mitigating price volatility risks through this "long-term order lock."

The impact on downstream application sectors is even more profound, encompassing multiple industries, including finance, healthcare, and the internet. In the financial sector, a joint-stock bank's intelligent risk control system upgrade, originally scheduled for the third quarter of 2025, was forced to be postponed to the first quarter of 2026 due to a shortage of AI servers, potentially impacting the efficiency of credit risk identification. In the healthcare sector, AI diagnostic medical imaging projects at several tertiary hospitals have stalled due to insufficient computing power, and the planned intelligent lung CT screening function cannot be launched on schedule. In the internet industry, projects such as optimizing AI recommendation algorithms for short video platforms and expanding the intelligent customer service systems of e-commerce platforms have been slowed due to server supply issues.

From an industry cost perspective, rising memory prices are exacerbating computing power cost pressures. Data from the China Electronics Standardization Institute indicates that my country's AI server market will reach 56 billion yuan in 2024 and is expected to jump to 63 billion yuan in 2025, with shipments reaching 486,000 units. Based on current memory price increases, domestic AI server procurement costs will increase by over 3.5 billion yuan in 2025. This cost may ultimately be passed on to end-use applications—for example, intelligent customer service, AI-generated content (AIGC), and autonomous driving data training—which may face pricing increases or capacity reductions.

Multi-sector Emergency Response: Government and businesses collaborate to resolve supply chain challenges, accelerating domestic substitution.

Faced with the escalating memory supply crisis, all parties involved in the industry chain and at the policy level have launched a multi-faceted emergency response, addressing the challenges through supply chain adjustments, technology optimization, and policy support. On the enterprise side, server manufacturers are adjusting their supply chain strategies. Inspur Information and Changxin Storage have reached a deep strategic partnership to jointly develop domestically produced DDR5 memory modules. The first batch of these products has entered the testing phase, with mass production expected by the end of 2025. H3C has launched a "Memory Flexible Configuration Plan," allowing customers to first receive a server with a basic configuration and then upgrade with additional memory modules once memory supply stabilizes, minimizing delivery cycles. Huawei, through optimizations to its Ascend chip architecture, has reduced memory consumption by 15% for the same computing power requirements, mitigating memory dependence from a technical perspective.

The channel market has also adapted, with some distributors offering "memory futures" services. Customers can pay a 50% deposit to lock in memory supply for one month. Despite a 20% price premium, many companies are choosing this model to ensure core business needs. According to market feedback, by September 2025, "memory futures" trading volume accounted for 18% of total memory procurement, a 12 percentage point increase from July, becoming an important supplementary method for alleviating supply pressure in the short term.

Policy support is also increasing. Regarding computing power infrastructure security, the Ministry of Industry and Information Technology recently held a special meeting to establish a "whitelist" system for memory chip supply, coordinating with international memory manufacturers such as Samsung and Micron to increase DDR5 memory supply to the Chinese market. At the same time, it required domestic memory module companies to prioritize server demand. At the local government level, Beijing proposed in its "Computing Power Infrastructure Construction Implementation Plan (2024-2027)" a 10% cost subsidy for server companies that purchase domestic memory chips, with an annual subsidy cap of 50 million yuan per company. Shanghai, through the "Computing Power Pujiang" special initiative, has organized server manufacturers such as Inspur and Huawei to connect production capacity with Changxin Storage, establishing a direct "demand-capacity" connection mechanism and shortening supply chain response time.

Accelerating domestic substitution has become a key breakthrough in resolving supply chain constraints. Changxin Memory's latest disclosures indicate that its DDR5 memory production capacity is increasing at a rate of 10% per month. By the fourth quarter of 2025, product yields had exceeded 95%, and the company is expected to meet 25% of China's server memory demand within the year. Furthermore, Changxin Memory has achieved full domestic production of DDR5 memory, from chips to modules, resulting in product costs that are 18% lower than comparable imported products, demonstrating a significant price-performance advantage. Changxin Memory is currently expanding its Hefei production base. Upon commencement of production in the second quarter of 2026, annual DDR5 memory production capacity is expected to increase to 800,000 wafers, meeting 40% of China's server memory demand. This will significantly reduce the domestic AI server industry's reliance on imported memory.

Industry experts point out that while the current memory shortage crisis has had a short-term impact on the AI server industry, it is also accelerating the industry chain's transition toward "independent and controllable" development. Through policy guidance, technological innovation, and domestic substitution, China's computing infrastructure is gradually building a more resilient supply chain, laying a solid foundation for long-term development. In the future, as domestic storage chip production capacity is released and server manufacturers optimize their technology, the AI server industry will gradually get rid of its dependence on imported memory and achieve healthy and sustainable development.