The memory chip industry is experiencing widespread price increases; major players like Samsung and Micron are all raising prices, leading to a shift in the industry landscape.

In the global semiconductor industry, the memory chip sector has always been a highly competitive and influential segment. Recently, this sector has been rocked by a major upheaval, with industry giants like Micron and Samsung announcing significant price hikes for their memory products, causing a frenzy in the market and attracting widespread attention from the entire industry and consumers.

Industry Giants Lead the Way: Price Hikes Sweeping the Market

Last week, Micron, a major player in the memory chip industry, kicked off the price hike trend by announcing a 20-30% increase in its memory product prices and suspending its quoting process. This move, like a bombshell, sent shockwaves through the memory market. As a globally renowned memory chip manufacturer, Micron's actions have a significant impact on the market. The suspension of quoting only fueled speculation and heightened tension regarding the supply and price trends of memory chips.

While the market was still digesting the impact of Micron's announcement, industry giant Samsung dropped an even bigger bombshell—confirming its participation in the price hike and with an increase that could be described as outrageous. According to the latest information from the supply chain, Samsung has urgently notified key customers that DRAM prices will be completely out of control in the fourth quarter! LPDDR4X, LPDDR5/5X protocols will see price increases of 15-30%. As LPDDR is a widely used memory technology in mobile devices, such a significant price increase will undoubtedly increase costs for downstream manufacturers of smartphones and tablets. Meanwhile, NAND-based eMMC and UFS protocols are also following suit, with price increases of 5-10%. eMMC and UFS are widely used for storage in smartphones, smart TVs, and other consumer electronics, and their price increases will further impact the prices of end products.

Supply Gap Widens, Tensions Mount

Even more alarming is the prediction that DDR4 production capacity in 2026 will be only 20% of 2025 levels, creating a terrifying supply gap and escalating tensions. DDR4 is a common memory type for computers and plays a crucial role in data processing and multitasking. Such a drastic reduction in production capacity means that DDR4 supply will be extremely tight in the future. With demand remaining relatively stable, or even potentially increasing with the advancement of digitalization, a significant reduction in supply will inevitably drive prices further upward. This may also force related industries to seek alternative solutions, but this is not something that can happen overnight, and the current market tension is unlikely to ease in the short term. Information from Micron also confirms the persistence of this price surge. Micron stated that this wave of memory chip price increases is unlikely to stop, and is expected to continue until the second quarter of 2026, effectively locking the long-term market trend in a "boom" cycle. This means that for a considerable period, rising memory chip prices will be the dominant trend in the industry, and downstream companies and consumers need to prepare for a long-term response.

Multiple Factors Behind the Price Increase

The recent collective price increase in the memory chip market is driven by multiple complex factors. From a supply and demand perspective, in recent years, due to global economic conditions and changes in consumer electronics market demand, the memory chip market experienced a period of oversupply, with prices remaining low, and many manufacturers even incurring losses. To change this situation, memory chip giants such as Samsung and Micron implemented measures such as production cuts and capacity adjustments to alleviate oversupply pressure. Over time, these measures gradually showed results, and the market supply and demand relationship began to shift, moving from oversupply to undersupply, creating the conditions for price increases.

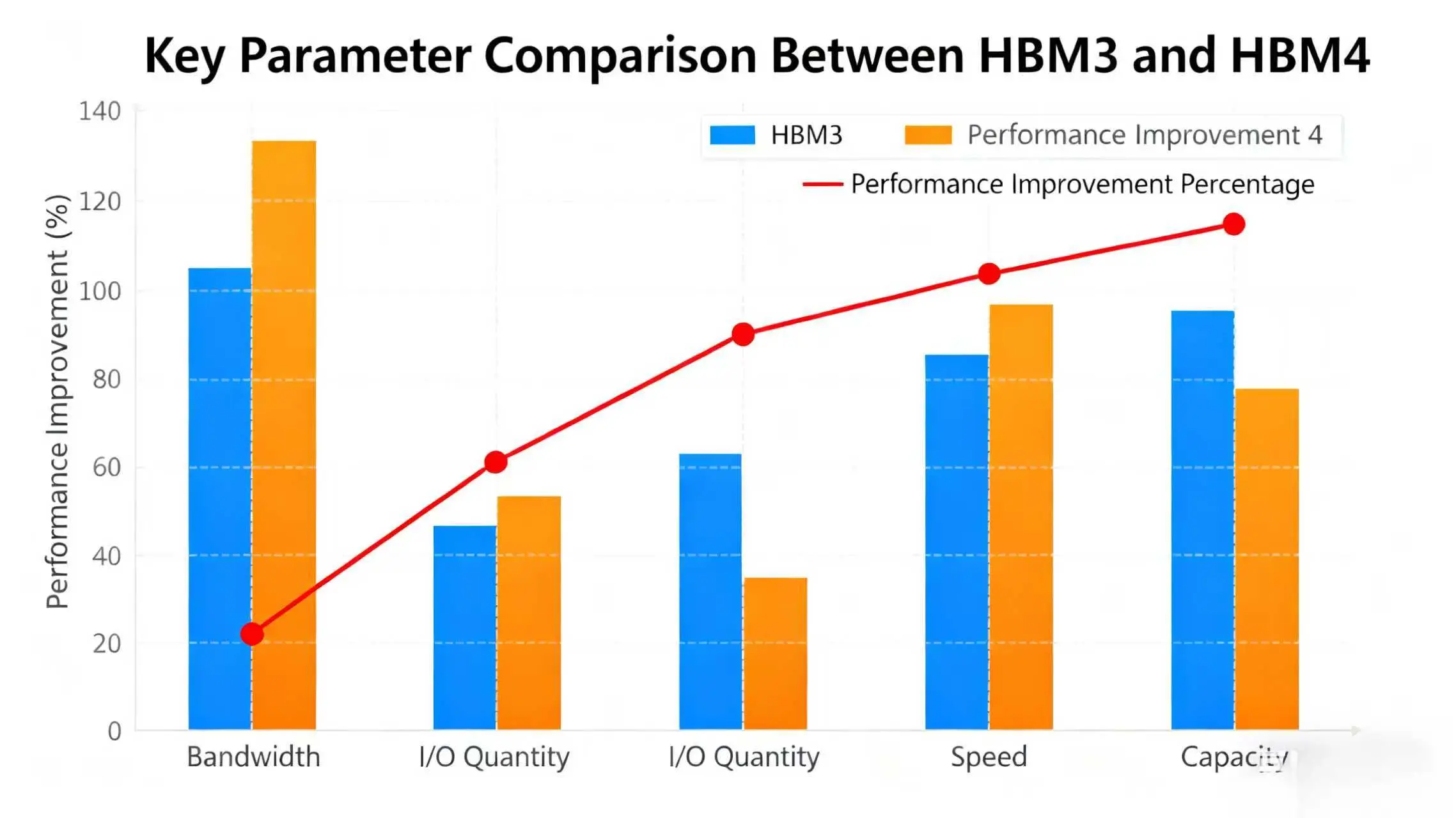

Technological iteration is also an important factor. Memory chip technology is constantly evolving, with new standards and products emerging, such as LPDDR5/5X. Meanwhile, the capacity of older technologies gradually shrinks during the technological transition, as seen in the significant decline in DDR4 production. While new technologies offer superior performance, their initial production capacity often cannot quickly meet market demand, leading to supply shortages during the transition period, thus driving prices up.

Furthermore, changes in the global semiconductor industry landscape have also impacted the memory chip market. Geopolitical factors and the restructuring of the semiconductor supply chain have all influenced the production, supply, and trade of memory chips. For example, restrictions on chip manufacturing in some regions have affected the global supply capacity of memory chips, further exacerbating market tension and providing external support for price increases. The Far-Reaching Impact on the Industry Chain and Market

The continuous rise in memory chip prices will have a profound impact on the entire semiconductor industry chain and related markets. For downstream electronic device manufacturers, the cost pressure will increase significantly. All kinds of electronic devices, from smartphones and computers to servers, rely on memory chips, and a sharp rise in their prices will directly drive up the production costs of these end products. In a highly competitive market, manufacturers will either have to reduce their profit margins or pass on the costs to consumers, which could affect the market price and sales of end products.

From an industry perspective, memory chip giants can potentially improve their profitability through price increases, further consolidating their market position. However, smaller memory chip companies may face greater survival pressures, with the gap in technology and capital resources widening further, potentially leading to increased industry concentration.

For consumers, the short-term impact will likely be higher costs for memory-related products. Upgrading computer memory, purchasing large-capacity storage devices, or buying a new smartphone could all cost more. However, in the long term, continuous advancements in memory chip technology are inevitable. As new production capacity comes online and technology matures, prices may gradually stabilize, though this will take time.

Future Outlook: Will the Price Surge Continue?

Currently, the memory chip price surge shows no signs of abating, with Micron predicting it will continue until Q2 2026. However, market dynamics are inherently unpredictable, and whether new factors will disrupt this trend remains to be seen. The effectiveness of the production cut and price increase strategies by memory chip giants depends on further changes in supply and demand. If demand declines significantly or new production capacity exceeds expectations, the basis for price increases could weaken. Furthermore, technological advancements could also impact the market. If more advanced, lower-cost storage technologies are rapidly commercialized, they could disrupt the existing memory chip market and alter price trends.

In summary, the current memory chip price surge is a result of multiple factors, and its impact on the industry chain and market is gradually emerging. Both industry players and consumers need to closely monitor market developments to better address the challenges and opportunities this change presents.