The US lifts restrictions on H200 chips, creating new development opportunities for the domestic data center switch market.

On December 9th, the US announced a policy adjustment that will impact the global computing power supply chain – the Trump administration allowed Nvidia to deliver H200 artificial intelligence chips to approved customers in China, and this policy also applies to similar products from companies such as AMD and Intel. This policy relaxation quickly triggered a chain reaction in the industry. Analysts from institutions such as Huatai Securities pointed out that domestic leading internet companies are expected to see a new wave of computing power procurement, and data center switches, which are standard equipment for computing clusters, will directly benefit. By 2026, this is expected to spur the development of new switch form factors such as Switch Trays, creating new market opportunities for domestic network equipment manufacturers.

I. H200 Chip Unbanning: Opening Up Incremental Space for Domestic Computing Power Procurement

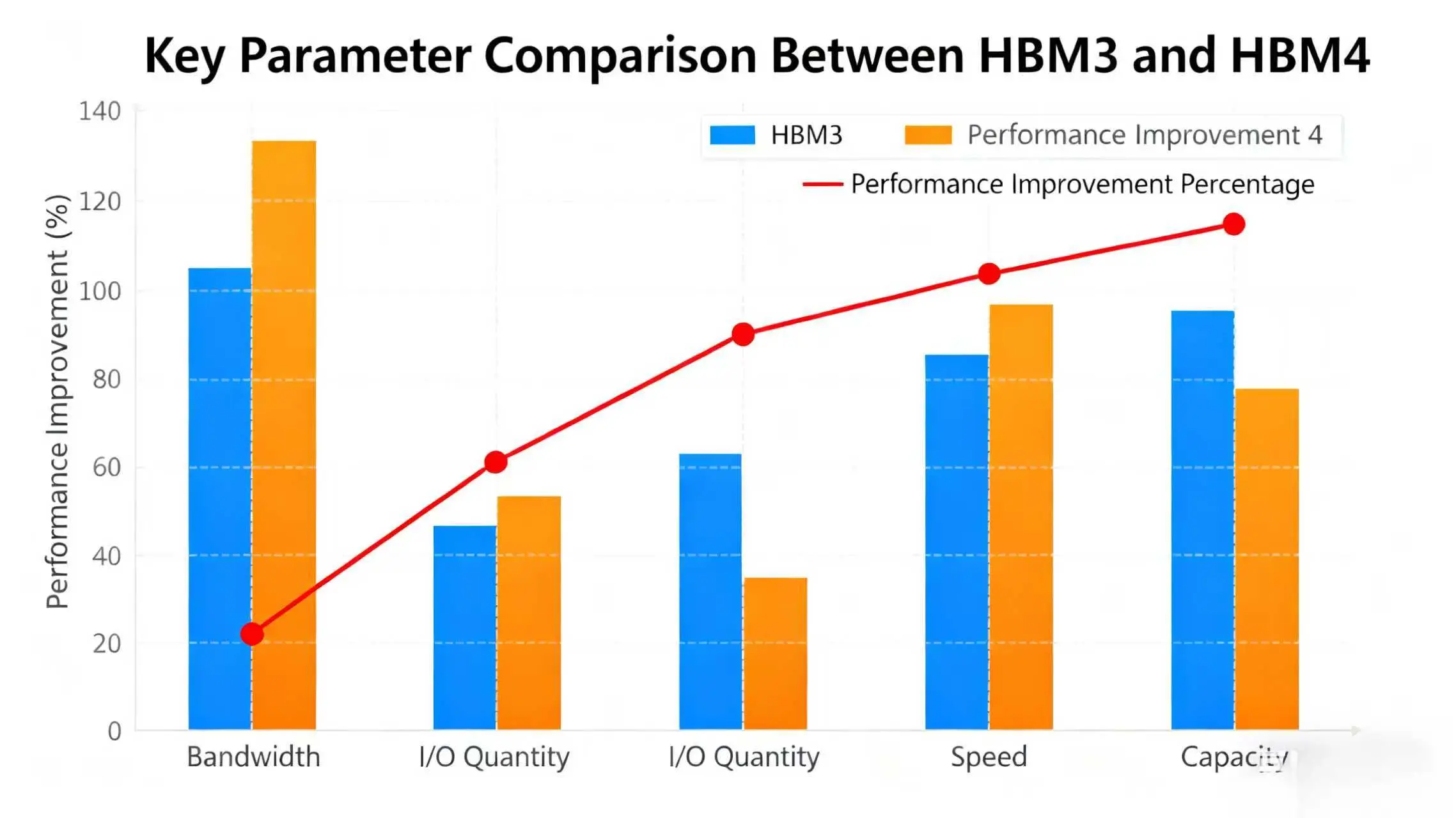

As Nvidia's core product for AI training and inference scenarios, the H200 chip boasts significant performance advantages. Public information shows that the chip is based on Nvidia's "Hopper" architecture and is the first GPU equipped with HBM3e fifth-generation high-bandwidth memory, with 141GB of memory capacity and a memory bandwidth of up to 4.8TB per second. Compared to the previous A100 chip, its memory capacity is nearly doubled, and the bandwidth is increased by 2.4 times. In the inference scenario of Llama 2 (a large model with 70 billion parameters), its speed is twice as fast as the H100 chip. Previously, due to export control policies, domestic companies had difficulty obtaining such high-performance computing chips, which to some extent hindered the progress of large model training and supercomputing center construction.

This policy relaxation is not an unrestricted opening, but rather a targeted license for "approved customers," and similar computing chips from Intel, AMD, and other companies are also included in the same licensing scope. Although Nvidia is required to pay 25% of its sales revenue from these chips to China to the US government, resulting in some additional costs, this adjustment still provides domestic computing power demanders with a compliant channel to obtain high-end chips.

From the perspective of domestic market demand, the computing power capital expenditures of leading internet companies are currently at a high level. Public data shows that Alibaba plans to invest over 380 billion yuan in cloud and AI hardware infrastructure construction over the next three years, a scale exceeding its total investment over the past decade; ByteDance's capital expenditure in 2025 is expected to reach 150-160 billion yuan, of which 90 billion yuan will be specifically used for AI computing power card procurement; Tencent will also increase its intelligent computing investment in 2025 to 82 billion yuan, a significant increase compared to 2024. Previously, due to chip supply constraints, some manufacturers faced bottlenecks in building computing power clusters. The compliant market entry of H200 chips will provide crucial support for these companies' computing power expansion plans, driving substantial growth in computing power procurement.

II. Data Center Switches: The "Essential Complement" for Computing Power Expansion

The construction and operation of computing power clusters are inseparable from high-bandwidth, low-latency network connections, and data center switches are the core hub in this link. With the increased computing power procurement by leading domestic manufacturers, the market demand for data center switches will also be released simultaneously.

From the industry perspective, my country's data center switch market has shown rapid growth. According to data from Guanyan Report Network, the overall market size of switches in my country reached 42.36 billion yuan in 2024, a year-on-year increase of 5.9%, while the data center switch segment grew far faster than the overall market, with a year-on-year increase of 23.3%; in terms of market share, data center switches accounted for 44.4% of the overall switch market in 2021, and this proportion is expected to rise to 51.7% by 2026, becoming the core engine driving the growth of the switch industry.

Technologically, 800G switches are becoming the mainstream choice for current data centers and AI computing scenarios. Compared to traditional switches, 800G products have achieved significant breakthroughs in bandwidth, latency, and energy efficiency: Ruijie Networks' 800G data center switches can reduce network latency by 50% and improve energy efficiency by 40%; H3C's 800GLPO switches have been deployed on a scale of over 100 units per customer in leading internet companies, supporting the stable interconnection of tens of thousands of GPU clusters; and ZTE's liquid-cooled switch solution has improved energy efficiency by 35%, securing orders for multiple large-scale data center projects. The large-scale deployment of these products provides technical assurance for the efficient operation of computing clusters.

Huatai Securities points out that the increased procurement of computing chips will directly drive the demand for data center switches. On the one hand, the increase in the number of GPUs per cluster places higher demands on the port density and switching capacity of switches, making high-end switches with speeds of 800G and above a key procurement focus; on the other hand, the distributed deployment of computing clusters requires switches to have stronger networking flexibility and intelligent operation and maintenance capabilities, which also opens up market opportunities for manufacturers with technological advantages.

III. The Rise of Domestic Manufacturers: Market Opportunities from "Catching Up" to "Running Alongside"

In the growth dividend of the data center switch market, domestic manufacturers have achieved a leap from "catching up" to "running alongside" through technological breakthroughs. Previously, the global data center switch market was dominated by overseas manufacturers such as Cisco and Arista, with the top five global manufacturers collectively holding 86.2% of the market share in 2024. However, in the domestic market, local companies such as Huawei, H3C, and Ruijie Networks have achieved dominance in specific segments.

The technological breakthroughs of domestic manufacturers are reflected in two main aspects: core chips and complete machine solutions. In the chip sector, Shengke Communications has independently developed a full range of switching architecture source code, possessing high-performance architecture design capabilities of 12.8Tbps/25.6Tbps. Its 12.8T products have been adapted to multiple domestic switches, and its 25.6T products have entered the small-batch shipment stage; Zhongji Xuchuang's 400G silicon photonics modules have achieved mass production, reducing energy consumption by 60%, and 1.6T silicon photonics modules have also begun incremental delivery, providing critical component support for the high-speed evolution of switches. At the system level, Huawei's CloudEngine series switches integrate AI algorithms, enabling automatic network traffic optimization, increasing AI computing power utilization from 50% to 100%, and improving data storage IOPS performance by 30%, becoming a core networking device for AI data centers.

Policy support has also provided fertile ground for domestic manufacturers. my country's "14th Five-Year Plan for Digital Economy Development" explicitly lists switches as core equipment for digital infrastructure and sets a quantitative target of exceeding 50% localization rate by 2025; the implementation of the "East-to-West Computing" project has directly driven over 20 billion yuan in data center switch procurement demand, further opening up the market space for domestic equipment. The computing power expansion demand brought about by the lifting of the H200 chip ban will combine with policy dividends to create more commercial opportunities for domestic data center switch manufacturers.

IV. 2026 Technology Outlook: Switch Tray Opens a New Networking Mode

In addition to the increased demand for existing products, Huatai Communications also predicts that in 2026, new product forms such as Switch Tray will emerge in the data center switch field, bringing new technological changes to the industry.

The emergence of Switch Tray stems from the "open decoupling" networking trend of computing power clusters. Currently, some manufacturers have proposed a "high-density cabinet" architecture, whose core design idea is to achieve decoupling of CPU and GPU, and open adaptation of hardware and software, and Switch Tray is a key component in this architecture. As a modular switching unit integrated into the rack, the Switch Tray features high-density ports and high-speed capabilities, allowing for direct connection to the Compute Tray (computing module) within the rack, significantly shortening the data transmission link and reducing network latency. At the same time, its standardized interface design is compatible with chips and modules from different manufacturers, enabling rapid deployment and flexible expansion of computing clusters.

In terms of application scenarios, the Switch Tray is more suitable for large-scale AI computing clusters. Taking a 10,000-GPU cluster as an example, traditional networking modes require several weeks for switch deployment and debugging, while modular networking based on the Switch Tray can compress the cluster deployment cycle to within a week, while also improving model training efficiency by 8%-18%. This advantage will make it a core networking solution for future supercomputing and intelligent computing centers.

For domestic manufacturers, the technological iteration of the Switch Tray presents both opportunities and challenges. Currently, domestic manufacturers have accumulated mature technological reserves in the 800G switch field, but the development of the Switch Tray requires breakthroughs in modular design, open interface standards, and low-latency transmission. Industry insiders point out that manufacturers who proactively invest in this area are expected to gain a head start in the next-generation computing network market.

V. Industry Outlook: Demand Growth and Technological Iteration as Dual Drivers

Overall, the lifting of restrictions on the H200 chip has injected a strong boost into the domestic computing industry, and data center switches, as the "vascular system" of computing clusters, will directly benefit from this wave of demand. In the short term, the computing capacity expansion plans of leading internet companies will drive the procurement demand for 800G switches, and domestic manufacturers are expected to further increase their market share with their cost-effectiveness and localized service advantages; in the long term, the technological iteration of new devices such as the Switch Tray will push the industry into a higher-level networking stage, and manufacturers with outstanding R&D capabilities will build core competitiveness.

It should be noted that industry growth still faces some uncertainties. On the one hand, the supply of overseas chips still faces policy uncertainties, and domestic companies need to balance "compliant procurement" with "independent and controllable" solutions in their computing power infrastructure development. On the other hand, competition in the data center switch market will become increasingly fierce, with overseas manufacturers accelerating their deployment of 800G and 1.6T products. Domestic manufacturers need to continuously strengthen their technological advantages. However, overall, the long-term growth logic of the computing power industry remains unchanged, and the market space and technological prospects of data center switches, as core supporting components, are still promising.